- Extension from equipment offerings into the fresh new first-lien HELOC

- Needs a huge erican people in the place of home financing)

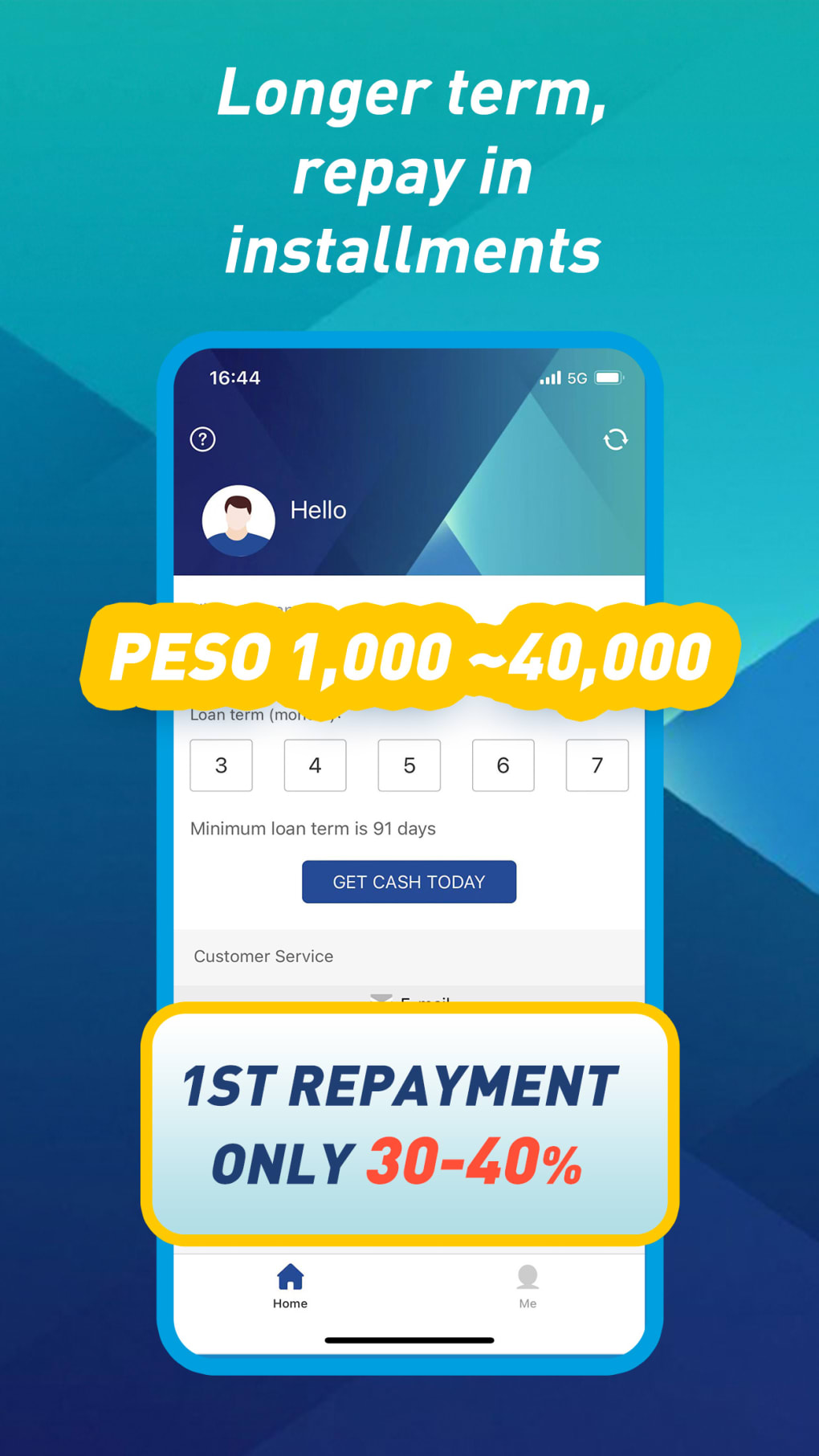

- Versatile terms together with three-season draw period and potential 10-seasons interest-simply percentage several months

- Phased federal rollout bundle, available today in the eight claims

- None.

Understanding

off Western property owners financial-totally free, the item tackles a hefty untapped opportunity. This new versatile terms, also good step 3-year mark several months and you can prospective ten-12 months desire-only costs, make it an attractive choice for people seeking to liquidity. So it expansion could diversify LDI’s money channels and you will potentially increase their share of the market yourself collateral lending area. Although not, brand new phased rollout method ways cautious optimism, allowing the firm to check on and you will refine the merchandise in advance of good complete national launch. Dealers is to display the brand new product’s adoption rates and its particular effect on LDI’s financials about upcoming household.

The fresh new time away from loanDepot’s equityFREEDOM Very first-Lien HELOC launch try smartly voice. Having people looking at checklist degrees of security and you will up against rising costs, new need for eg situations is likely to raise. The fresh new item’s independence caters to certain user demands, at home home improvements so you can debt consolidating, possibly growing its interest. The original rollout in seven claims, in addition to big avenues like Ca and you may Fl, allows a managed extension and you will sector comparison. This approach may help LDI improve its providing centered on very early use patterns until the structured national extension of the later 2024. The prosperity of the item you can expect to somewhat impact LDI’s aggressive position regarding the changing family collateral field.

Which item’s judge framework could put a great precedent for similar offerings in the industry

The new equityFREEDOM Earliest-Lien HELOC introduces specific court considerations for both loanDepot and you will customers. Since a primary-lien equipment, it will require priority more than any next liens, probably affecting borrowers’ upcoming investment solutions. The newest reference to prospective income tax deductibility try prudently licensed, taking the fresh complexity from taxation ramifications. The fresh new differing terms around the claims emphasize the need for mindful regulating conformity. LDI must ensure clear revelation away from terms and conditions, particularly about your attention-only months and then amortization. Because product increases nationally, staying through to county-particular lending regulations might be crucial.

IRVINE, Calif. –(Team Wire)– loanDepot, Inc. (“LDI” or “Company”) (NYSE: LDI), a leading seller of products and characteristics you to stamina the fresh new homeownership travel, has expanded its equityFREEDOM unit collection to https://paydayloanalabama.com/pell-city/ add a first-lien home security personal line of credit (HELOC). The new HELOC allows the newest

from Western people instead a mortgage step 1 to borrow using their residence’s guarantee for high expenditures eg household home improvements or college or university university fees, or even consolidate higher focus credit card debt. It adds an alternative powerful economic tool in order to loanDepot’s portfolio of goods and qualities you to definitely support the lifetime homeownership trip of their consumers.

“Homeowners is sitting on unprecedented levels of collateral right now, like people who not bring home financing,” said LDI President Jeff Walsh. “But not, also as opposed to home financing, of a lot feel the pinch out-of ascending expenditures, as well as insurance rates and you will assets taxation, hence lay more stress towards the monthly budgets. That’s why we’ve added the original-lien option to all of our security lending collection to help with our people from entirety of its homeownership travel, not merely inside the life of its mortgage.”

The ability to make use of security are a major benefit of homeownership as you can lessen the price of credit getting high costs – and you may, in many cases, the eye is tax-deductible dos . An initial-lien HELOC is actually for borrowers that simply don’t keeps a preexisting home loan on the house step three .

The equityFREEDOM First-Lien HELOC allows such as for instance borrowers to get into the newest equity inside their belongings having flexible terms and conditions including an effective about three-season draw period, and you will, for the majority claims, an excellent 10-season attention-merely percentage several months followed by good 20-12 months amortizing fees identity 4 .